UKPL offers analysis of the UK’s container facilities from the major deep sea hubs through to the regional ports that play a vital role in both national and local supply chains.

There are close to 600 container ports across the world with an estimated combined handling capacity of 450 million TEU. The largest ports are those that can handle in excess of 1 million TEU per annum, and they account for around two-thirds of global capacity. In 2015 three UK port complexes handled more than 1m TEUs; Felixstowe (4.0m), Southampton (2.0m), London - Gateway and Tilbury - (1.2m). The introduction of ultra-large containerships has had a major impact on the logistics industry and has redefined the role of major ports across the global maritime trade routes, including the UK. The truly efficient large ports, outside the range of pure loading ports (in China) and pure discharging ports (for example in the Middle East) are those with a significant hinterland for gateway traffic as well as sufficient quayside and landside facilities for either portcentric value-added activities or transhipment services.

THE UK CONTAINER MARKET

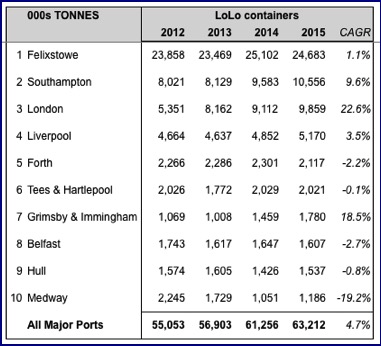

Recently UK container ports have witnessed significant investment in facilities and port assets to support annual traffic growth projections. For example London Gateway, opened in Q4 2013, was one of the most significant pieces of new port and logistics infrastructure in Europe with a reported capital investment of £1.5billion, and the Port of Liverpool has invested around £400m in a new deep water container terminal which opened in Q4 2016. In combination with the expansion of container handling capacity for deep sea trades at the Ports of Felixstowe and Southampton, and Feeder services primarily from the Port of Rotterdam, these ports provide UK supply chains with significant capacity for growth in container traffic. However, the changing competitive landscape has resulted in significant decline of container throughput at Thamesport in the Medway region. Concurrently, UK regional ports such as Immingham and Teesport have maintained and grown their market share, based on their hinterland connections and potentially lower cost solutions.Capacity for international transport of UK exports is exemplified by the prevalence of empty containers on the UK transport network. In 2015 over 40% of laden containers handled through UK ports, and carried on the UK transport infrastructure, were returned as empty boxes into the global carrier networks. The table below is based on laden containers only.

Container traffic analysis by UKPL can be shaped to suit individual enquiries, for example in TEUs, in units, by cargo weight, laden and empty, by country and by port.

UKPL and its expert Associates offer comprehensive analysis of container market trends, terminal capacity, road and rail connectivity and future growth opportunities